Personal

GRB provides flexible options to help you create a strong financial foundation. Contact our team to open an account, today!

Supporting Your Financial Goals With Flexible Savings Accounts

GRB offers savings account options to meet you wherever you are in your financial journey. From basic Statement accounts to Elite, GRB’s offers free online banking, free e-Statements, and the opportunity to earn interest as you save. Your GRB savings account is also FDIC insured up to $250,000 per account, per depositor.

Take a look at our account options below and contact a Relationship Banker for more information.

Statement

A Statement savings account is a great first step toward financial strength. Easy to open, easy to earn, and easy to manage. A GRB Statement savings account is a positive move for the future!

Money Market

A Money Market account provides higher interest rates on your savings – the more you save, the more you earn. Let our team help you set up a personal money market account and start earning!

Elite Money Market

An Elite Money Market account provides extra earnings potential with a tiered account that helps you earn and save more – coupled with GRB’s private banking team to keep your finances in growth mode.

Enroll In The Account That Fits Your Everyday Banking Needs

At GRB, we offer a range of savings accounts because we understand that banking isn’t one-size-fits-all and neither are your financial plans and goals. By comparing all GRB savings account options, you can be sure you’re always moving forward in your financial planning and strategy. If you need additional assistance, reach out to our Relationship Banking team.

Why Should I Have A

Savings Account?

A savings account serves as the cornerstone of financial stability and security.

By regularly depositing funds into a savings account, individuals have one of the core tools of personal finance. A savings account helps:

- Create a buffer against financial emergencies, such as medical bills or car repairs, and mitigating the need to resort to high-interest debt.

- Facilitate long-term planning, whether it be for education, homeownership, retirement, or other significant milestones. They offer a secure and accessible way to accumulate more wealth over time.

- Foster financial discipline and responsibility and empower individuals to take control of their financial future.

- Protect funds from the risk of loss due to theft or disasters. Funds in a savings account are also insured by the FDIC.

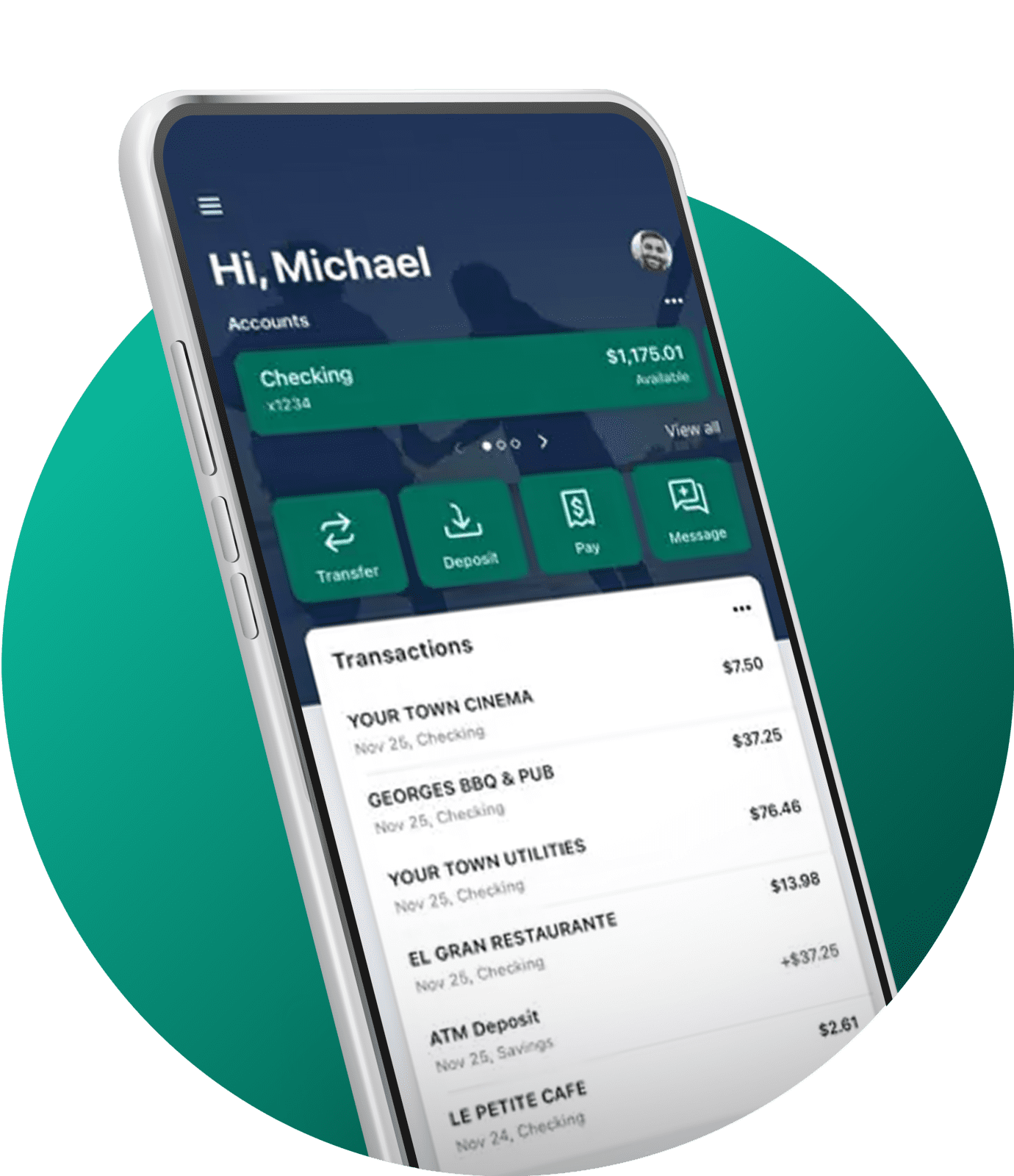

HERE. FOR YOU.

WHEREVER ‘HERE’ IS!

GRB online and mobile personal banking capabilities offer a full suite of tools designed to make it easier to do your banking wherever you are and whenever you need to!

Download the GRBbank App

Use the links below to download the app to your phone and start banking on the go, today!

Find a Branch or ATM

Need an ATM or GRB Branch? Follow the arrows below to find our branches and surcharge-free ATMs throughout the region, across the country, and even around the world.

Contact Us Today

Use the dropdown below to fill out our ‘Contact Us’ form, and a GRB Relationship Banker will be in touch with additional account information!