Personal Checking

GRB’s Relationship Banking team is ready to help you find a checking account that meets your personal financial goals.

Supporting Your Day-to-Day With Flexible Checking Accounts

If you’re tired of “taking a number” and “being a number,” give our top-notch Relationship Banking team a try! At GRB, our customers enjoy a service experience that ensures they are more than just an account number.

Value Checking

Banking shouldn’t be complicated – our GRB Value Checking account exemplifies that! Just a simple and easy account with access to 100,000 surcharge-free ATMs worldwide and free online banking.

Reward Checking

Start earning up to 4.00% Annual Percentage Yield (APY)* on your everyday banking habits!

* Annual Percentage Yield (APY) offered is accurate as of 5/16/2025. Fees could reduce earnings on the account. Rates and terms may change without notice after account opening.

Elite Checking

GRB’s Elite Banking program provides a highly personalized private banking experience for accountholders with more complex financial needs and higher account balances.

Enroll In The Account That Fits Your Everyday Banking Needs

At GRB, we offer a range of savings accounts because we understand that banking isn’t one-size-fits-all and neither are your financial plans and goals. By comparing all GRB checking account options, you can be sure your take a progressive step in your financial planning and strategy.

If you need additional assistance, reach out to our Relationship Banking team.

Why Do I Need a

Checking Account?

Maintaining a checking account is an important foundation for your financial success. A checking account:

- Serves as the home for your payroll via direct deposit

- Works with your mobile device to bank on the go

- Creates easy payments via paper check or online

- Provides a monthly overview of your spending

- Is insured (up to $250,000) by the FDIC

HERE. FOR YOU.

WHEREVER ‘HERE’ IS!

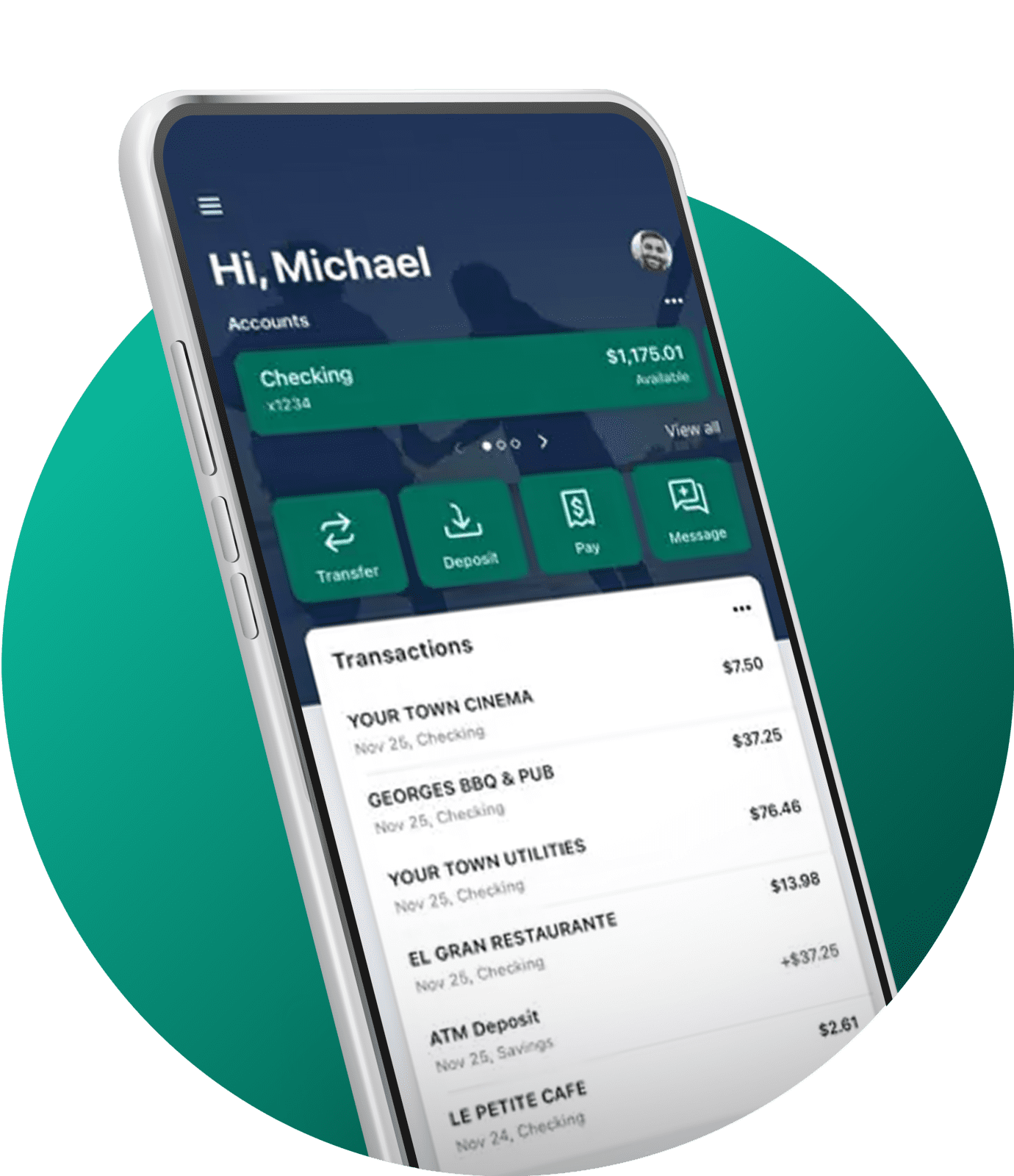

GRB online and mobile personal banking capabilities offer a full suite of tools designed to make it easier to do your banking wherever you are and whenever you need to!

Download the GRBbank App

Use the links below to download the app to your phone and start banking on the go, today!

Find a Branch or ATM

Need an ATM or GRB Branch? Follow the arrows below to find our branches and surcharge-free ATMs throughout the region, across the country, and even around the world.

Contact Us Today

Use the dropdown below to fill out our ‘Contact Us’ form, and a GRB Relationship Banker will be in touch with additional account information!